Travel

Tata AIG Travel Insurance: Comprehensive Coverage for Every Journey

Traveling, whether for leisure or business, can be an exciting experience. However, unforeseen events like medical emergencies, trip cancellations, or lost baggage can turn that excitement into a nightmare. That’s where Tata AIG Travel Insurance comes in. In this article, we’ll dive deep into the features, benefits, and various plans that Tata AIG travel insurance offers, making sure you’re well-equipped to make an informed decision before your next trip.

Why Choose Tata AIG Travel Insurance?

Tata AIG is a trusted name in the insurance industry, and their travel insurance plans are tailored to meet the diverse needs of travelers, whether you’re going on a family vacation or a solo business trip. With comprehensive coverage, an easy claims process, and exceptional customer care, Tata AIG ensures that you can travel with peace of mind.

Key Features of Tata AIG Travel Insurance

1. Comprehensive Coverage

One of the standout features of Tata AIG travel insurance is the wide range of coverage it offers. Whether you’re dealing with a medical emergency or a trip disruption, Tata AIG ensures that you’re covered.

Here’s a snapshot of coverage features:Tata AIG

| Coverage Type | What’s Covered |

|---|---|

| Medical Emergencies | Hospitalization, surgery, medical repatriation |

| Trip Cancellation/Delay | Non-refundable expenses due to cancellations |

| Lost Baggage | Compensation for lost or delayed baggage |

| Personal Accident Coverage | Accidental death or disability coverage |

| Passport Loss | Cost for reissuing a lost passport |

| COVID-19 Coverage | Medical expenses and quarantine costs related to COVID-19 |

2. Plans Tailored to Your Needs

Tata AIG offers various travel insurance plans, ensuring that every traveler finds the perfect fit:

- Tata AIG overseas travel insurance: Ideal for international trips, offering extended coverage for medical emergencies abroad.

- Family travel insurance: Covers all family members in one policy, making it easier and cost-effective.

- Student travel insurance: Designed for students studying abroad, covering educational interruptions, medical expenses, and more.

- Schengen travel insurance: Required for travel to Schengen countries, meeting visa requirements while offering extensive protection.

3. Quick and Easy Claims Process

No one wants to deal with complicated claims while traveling. Tata AIG has a simple and streamlined claims process, ensuring that you can focus on your trip without the headache of insurance formalities. In fact, Tata AIG’s customer care is renowned for its quick responses, ensuring help is always available in case of any emergency.

Tata AIG Travel Insurance Premiums and Benefits

Understanding Premiums

The premium for Tata AIG travel insurance depends on several factors such as:

- Destination: Traveling to certain countries can increase your premium due to higher healthcare costs or greater risks.

- Trip Duration: The longer the trip, the higher the premium.

- Age of Traveler: Senior citizens may have higher premiums due to greater health risks.

- Coverage Type: A comprehensive plan with more features will naturally cost more than a basic plan.

What Are the Benefits?

Tata AIG’s travel insurance benefits extend far beyond basic coverage:

- Cashless hospital network: Access to cashless hospital services across various international destinations.

- Personal liability coverage: Protects you from liabilities due to accidental injury or property damage to others.

- 24/7 customer support: Tata AIG’s support team is available around the clock to assist with any policy or claims queries.

Types of Tata AIG Travel Insurance Plans

1. Tata AIG Overseas Travel Insurance

For those venturing outside of India, the Tata AIG overseas travel insurance plan provides comprehensive protection. Whether you’re traveling for business, education, or leisure, this plan covers everything from medical emergencies to trip delays. It’s particularly useful in regions like Europe, the US, and Asia, where healthcare costs can be exorbitant.

2. Student Travel Insurance

Studying abroad is an exciting but often daunting experience. Tata AIG’s student travel insurance helps students by covering medical emergencies, educational interruptions, and even sponsor protection in case of unforeseen circumstances.

3. Family Travel Insurance

Family travel insurance by Tata AIG ensures that the entire family is covered under a single policy. This plan provides coverage for everything from medical emergencies to lost baggage, ensuring that family vacations are stress-free.

4. Schengen Travel Insurance

Planning a trip to Europe? A Schengen travel insurance plan is mandatory to get your visa approved. Tata AIG’s plan not only meets the visa requirements but also ensures that you have medical coverage in case of an emergency.

Real-Life Example: How Tata AIG Travel Insurance Saved the Day

Ravi’s Experience with Tata AIG Travel Insurance

Ravi, a 35-year-old IT professional, was on a business trip to Germany when he suddenly developed a severe allergic reaction. Fortunately, Ravi had opted for Tata AIG overseas travel insurance, which covered all his medical expenses, including hospitalization and treatment. Without this insurance, Ravi would have faced a hefty bill of over €5,000. Tata AIG’s cashless hospital network ensured that he received timely care without the hassle of upfront payments.

Exclusions: What Tata AIG Travel Insurance Doesn’t Cover

While Tata AIG’s plans are comprehensive, there are certain exclusions to keep in mind:

- Pre-existing conditions: Medical conditions that existed before purchasing the policy may not be covered unless specifically included.

- Adventure sports: Activities like skydiving or bungee jumping may require special add-ons for coverage.

- War and civil unrest: Losses incurred due to war, civil unrest, or terrorism may not be covered unless explicitly mentioned.

Tata AIG Travel Insurance for Senior Citizens

Traveling as a senior comes with its own set of concerns, and Tata AIG travel insurance for senior citizens addresses these with tailor-made plans that offer comprehensive medical coverage. This includes hospitalization, repatriation, and even personal accident coverage. Seniors traveling abroad, especially to countries with high healthcare costs, benefit greatly from this specialized plan.

COVID-19 and Tata AIG Travel Insurance

With the ongoing impact of the pandemic, many travelers are understandably concerned about COVID-19 coverage. Tata AIG travel insurance now includes provisions for COVID-19-related medical expenses, including quarantine costs and hospitalization. This is crucial for anyone traveling internationally during these uncertain times.

How to Buy and Renew Tata AIG Travel Insurance

Purchasing Tata AIG travel insurance online is a breeze. Here’s a step-by-step guide:

- Visit Tata AIG’s website: Navigate to the travel insurance section.

- Choose your plan: Select the travel insurance plan that best suits your needs.

- Enter your travel details: Input your trip dates, destination, and personal details.

- Get a premium quote: Based on your details, you’ll receive a premium quote instantly.

- Make the payment: Pay online using a debit/credit card or net banking.

- Receive your policy: Once payment is completed, you’ll receive your policy document via email.

Renewal Process

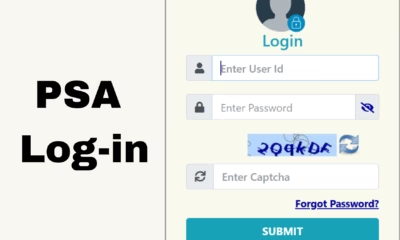

To renew your policy, simply log in to your Tata AIG account and choose the renewal option. It’s fast, easy, and ensures continuous coverage without interruption.

-

Sport10 months ago

Sport10 months agoIs Christie Sides Married? Exploring the Personal Life of a Renowned Basketball Coach

-

Food10 months ago

Food10 months agoNew Restaurants in Canton, CT – 2025

-

Blog10 months ago

Blog10 months agoUnleash Your Potential at FBYANA Fitness Indonesia Gym

-

Games10 months ago

Games10 months agoHow to Get Candies in Pokerogue: A Complete Guide

-

Games10 months ago

Games10 months agoHow to Get Spoonful in Slap Battles: A Complete Guide

-

Blog10 months ago

Blog10 months agoSimone Biles Biological Parents: Understanding Her Journey

-

Health9 months ago

Health9 months agoThe Ultimate Guide to Goblet Squats

-

Entertainment10 months ago

Entertainment10 months agoIs Taylor Swift Pregnant? Exploring Viral Rumor About ‘Baby Bump’ Video